Address:

128 City Road, London, EC1V 2NX

TheBusinessFunds specialises in connecting businesses in the UK with responsible, relevant funding solutions that match their needs. We are an independent business loan broker that connects companies to trusted commercial lenders.

We help limited companies, established businesses, and partnerships secure the funds they need. They can also use the funds to grow, maintain a steady cash flow, or explore new opportunities.

TheBusinessFunds is a UK business loan broker. We introduce businesses to suitable lenders and do not offer loans directly. We do not offer personal loans. We are not authorised or regulated by the Financial Conduct Authority (FCA).

Established in 2015, TheBusinessFunds has become a pioneer in providing flexible business solutions to UK companies. We know the importance of financing in achieving business growth and goals. Therefore, we work on a wide array of business funding options.

We believe in enduring partnerships with UK businesses. Consequently, we are dedicated to providing comprehensive support and guidance until your business achieves growth.

Company information:

Our priority is transparency when comparing loan deals for your business.

(Founder and Managing Director)

James has more than 15 years of experience in UK business finance and lending. He has worked with many financial institutions, such as banks and private lenders. He founded the company in 2015 to simplify business funding for UK companies.

(Director of Commercial Finance)

Daniel specialises in tailoring financing for companies across various sectors. He has strong skills in credit review and negotiating with the lender. He works carefully with businesses to identify their needs and offers practical guidance.

(Head of Lending Partnerships)

She operates relationships with the company’s wide network of UK lenders. She has vast knowledge of setting criteria and assessing risk. She ensures clients are matched with the right lending firms. Charlotte also handles recent updates in the UK alternative lending market.

Our team has years of combined experience in the UK business finance market. Since our establishment, we have helped several businesses across sectors, which include:

We provide our assistance by understanding the real challenges these industries face. For instance:

Till now, we have arranged funding help from small working capital needs to long-term business loan facilities.

We are an independent commercial finance broker, offering access to a range of business loan products. These include:

We work with alternative business loan providers, some traditional banks and specialist commercial finance providers across the UK lending market.

Our loan experts match the businesses with the lenders on these criteria:

We keep our focus on your affordability and suitability, not only on approval.

We always believe in processing business funding transparently and straightforwardly.

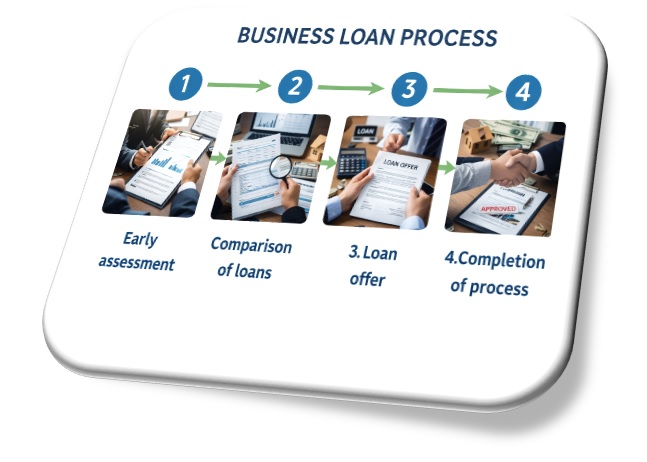

Step 01: Early Assessment

You need to share details about your business, funding needs, and trading history.

Step 02: Comparison of loans

We review your application and start comparing the lenders from our panel.

Step 03: Loan offer

We now present available funding options. They involve clear costs, repayment terms and conditions.

Step 04: Completion of the process

Once you accept the loan offer, the lender completes a credit check and releases funds directly to your business account if approved.

You are free to proceed with or decline any offer. There is no obligation to accept any of them.

We carefully select the commercial lenders for our panel. These include established banks, private lenders and alternative finance providers of the UK.

Our selection of lenders is based on the following criteria:

We are the broker, and we receive commission from lenders only if the loan agreement is completed. It does not change the loan cost unless it is mentioned in your loan offer.

Since our inception in 2015, we have been a firm believer and follower of ethical and responsible broking.

Businesses can look for regulated financial products from the lenders authorised by the Financial Conduct Authority. Still, we suggest you review the terms given in the loan agreement carefully.

A real-time example

In November 2025, a Manchester-based construction company approached us. It needed £80,300 in working capital to manage payroll and meet its supplier commitments. It required that money during a delayed project payment period.

We first reviewed their trading history and overall credit report. Based on that, we introduced a suitable lender and provided a tailored repayment plan that matched their expected returns. The construction company received funding within a couple of days of final approval. It allowed the business to run its operations smoothly.

Our mission is to ensure responsible, transparent, and more accessible business funding. Suitable finance supports businesses in creating more jobs, attracting investment, and strengthening local economies.

Business owners want to connect with us because we give them the following advantages.

Moreover, TheBusinessFunds complies with UK data protection legislation and GDPR norms. We securely handle your data and share it with appropriate lenders only for assessment purposes.

We needed £70,000 due to unpaid invoices. The team clearly explained the different loan options for my company and introduced a lender that aligned with my preferences. The process was streamlined, and I received the funds within 2 days of approval. Thank you for being professional and transparent throughout.

We started our e-commerce business in 2023, and in January 2026, we decided to expand our stock. We needed flexible funding to manage the expenses. I approached TheBusinessFunds, and the company carefully assessed my trading history and presented various lenders offering flexible loan terms. There was no pressure, and I chose a lender on my own.

I was looking for an unsecured business loan to purchase healthcare equipment. I called TheBusinessFunds for alternative funding options. They matched my needs with a suitable lender from their panel. Besides, they kept us informed throughout the process. Thanks a lot for keeping clear communication and helping me with a relevant financing solution.