In January,non-financial businesses in the UK (Public corporations and PNFC) borrowed 0.3 billion from banks and building societies. Alternatively, small and medium-sized businesses increased borrowing from 1.0 billion in December 2023 to a net repayment of 0.1 billion in January 2024. The growth of large enterprises in borrowing increased by 1.3% in January 2024 from 0.7% in December. It reveals the status of business debts at the beginning of the year. However, the business struggled to settle business debts after that.

Common reasons for pending business debts

Low business cash flow is the primary reason for loan debts. According to a report by “the EY reports“ costs of living pressures and economic uncertainty lead to low cash flow. Businesses stretching the affordability mark to meet needs may suffer drastically. It may lead to business loan default.

- Cost of living crises impact business and customers

The sale of furniture, electronics, appliances and electrical remained weak in 2023. Additionally, non-food sales decreased by 1.8% from January to April 2024. It contrasts with the growth of 2.8% in January 2023.

- Changing customer behaviour

With the cost of living crisis, only 1 in 5 businesses aim to increase product prices. The primary reason for that is changing or shifting consumer behaviour. They prefer sustainability over lavish goods and services. They increasingly prioritise health and well-being over everything. It is the reason behind the slow revenue growth.

Customers prioritise discounts, rebates, and bargains on groceries and other stuff. This is why “56% of customers plan their expenses before spending.” Out of this, 40% plan to spend less. The low-spenders break into two categories: mid-earners and mid-earners.

- Supply chain disruption

The situation in the Middle East impacted trade worldwide. The construction industry is the worst sufferer of trade restrictions because it relies on raw materials. Disruption in the supply chain impacted business goals largely.

With debt spiralling and low cash flow, individual businesses resort to professional debt management agencies/advisors.

How do professional business debts management experts operate?

A specialised debt collection agency helps businesses, lenders, and creditors manage overdue payments. In the case of businesses, it helps settle business debts by contacting the creditors and managing the pending debts on the borrower’s behalf. They negotiate the payments with the creditors after analysing the exact you can pay.

Commercial debt management plan providers charge a fee for their services. They work in the best interest of the firms to settle the debt.

What is the success rate of a debt management plan by experts?

The success rate of a debt management plan depends on factors like:

- Quality of business services

- Business requirements

- Ability to meet the satisfaction regarding pending payments

According to a source, the success rate of a Debt management plan is 45-50%.

PROS and CONS of hiring professionals for debt management

Businesses facing no apparent solutions contact debt management professionals. They help you with negotiating lower interest rates with creditors. It helps the business save a lower amount for debt reduction. However, some debt management companies do not deal with secured business debts. Here are other advantages and disadvantages of debt management:

| Pros of hiring professionals | Cons of hiring professionals |

Helps you simplify debt payments with an organised payment plan. It helps one regain control over debts | It is a long-term commitment and may involve monthly payments. It may take time for the business to achieve financial freedom |

Help businesses avoid legal actions by creditors. Without any CCJ or bankruptcy notice, it helps you preserve your business reputation. | Enrolling for DMP can negatively affect the credit rating. It may further limit access to credit. Longer agreements further make it challenging for a business to improve credit. |

Can prove a time save if a business finds managing debts a hassle | Although the firms help avoid legal action, they do not protect the business against it. The creditor may refuse to accept the terms provided by a debt settlement company. |

Debt management companies may help you settle debt. However, one must not overlook the impact on the credit and long repayment period. It may affect the business goals further.

If not a debt management plan, how can you manage debts better?

Reliable solutions to settle business debts quickly

The best way to deal with debts is to take an individual stand. No matter how challenging it may seem, one must try.

Begin with analysing the best solutions to tackle business debt. For example- categorise and organise the debts. It involves analysing the total debts you owe. It may include utility bills, pending supplier payments, equipment lease payments, credit card debts, etc. Analyse other aspects like-

It will help you categorise the loan from the most expensive to the least costly. Plan payments for the debt with the highest interest rates. Here are other ways that may help you settle debt quickly.

- Get instant funds against pending invoice

Most individuals struggling with business debt management choose this way to settle debt. Invoice financing helps businesses get instant funds against pending customer invoices. It is ideal for businesses which:

- Need instant cash for business needs

- Have pending client invoices

- If you have been waiting for 60 days or more, it may help

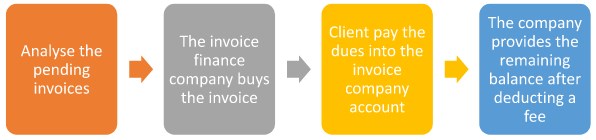

How does invoice finance work?

Here is how you can get instant money for your business needs with invoice finance

If applying for invoice finance for the first time, the process may seem confusing. You need an expert to find the right loan providers to get the best deal. Here, experts like invoice finance brokers may help you cut the hassle. It helps you find the best lender without struggling with the best quotes, talking with every lender, or explaining the need in detail. He requires a commission for the services.

- Settle debt by spreading payments

Businesses with inconsistent or low monthly earnings may benefit from this arrangement. You can settle your debts with a long-term debt consolidation solution. For example, you can choose the most expensive loans to consolidate first. It could be credit cards, short-term business loans, car finance, or personal loans.

You can consolidate these with long-term business loans hassle-free.

You can opt for a tenure of up to 15 years on the loan repayment. However, increased loan tenure means high interest costs. Thus, choose a comfortable term within which you can pay the dues. The long-term loan involves low monthly payments. It means you can balance other business expenses easily.

Otherwise, you can finance the business costs using the loan. For example, if you run a dental business, you can use dental business loans for financing equipment costs, hiring and other expenses.

- Check the possibilities of refinancing debt

Refinancing debts may help you fetch better interest rates on the existing debts. However, do not hurry. Analyse whether it will be useful from the long-term perspective or not. If yes, refinancing is the best way to reduce the interest rates and monthly repayment amount. It leaves you with more money to manage other business expenses. Additionally, you can reduce the overall loan costs.

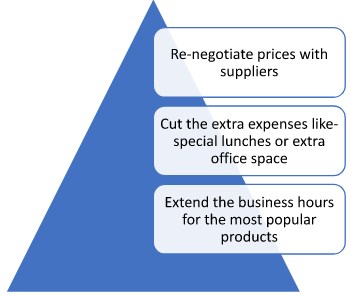

- Try to reduce spending and boost income

Around 85% of debt accumulation is due to mismanaged finances. Minimising your business expenditure will help you settle business debt quickly. Here are some strategies to reduce business expenses quickly:

It will help;p you save more and utilise savings towards debt. However, if you encounter any critical need midway, an instant business loan may help. It is the best way to counter any business-related need within 20 minutes. You can use it for instant inventory updates, finance the car repair, or bridge supplier’s payment. It is an unsecured loan that only requires you to reveal the affordability.

Bottom line

These are some expert ways to manage your business debts without hiring an expert. Hiring the best broker for your debt settlement is the best choice. He may help you get the instant cash whenever you need it. You need to provide an invoice as collateral. Apart from that, regulating finances well with critical management helps you save more. You can use it to clear debt quickly.

Gary Weaver is a Senior Content Writer with having an experience of more than 8 years. He has the expertise in covering various aspects of business market in the UK, especially of the lending firms. As being the senior member, he contributes a lot while working at TheBusinessFunds, a reputed business loan broker.

Gary performs the major role of guiding loan aspirants according to their financing needs and also to write research based blogs for the company’s website. Previously, he has worked with many reputed business firms and therefore, he knows every nook and cranny of business financing market of the country. Gary is a post-graduate with having a degree of Masters in English language. He has also done post-graduate diploma in Business and Finance.